We realise how difficult it can be to understand the intricacies of the investments in your scheme. Fund managers can bamboozle you with technical detail. Often you may question if the portfolio is structured to meet your objectives and if risk is effectively being managed. We help you by proving an independent audit to uncover the real risks associated with the investments in

your portfolio.

As a trustee, you are responsible for ensuring your scheme is managed in the best interests of your members, without exposure to unnecessary risk. We help you by proving an independent audit to uncover the real risks associated with the investments in you portfolio.

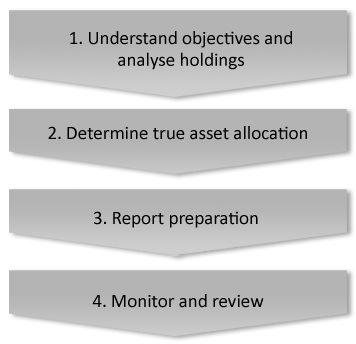

Step 1: Understand objectives and analyse holdings

Using a combination of interviews and analysis, we identify the objectives of your scheme and the strategies being deployed. We review your asset allocation to ensure it is aligned with your objectives, then analyse the investment styles of the underlying managers. We assess how they generate returns and evaluate whether the asset class title they have been given, matches the style they actually employ

Step 2: Determine true asset allocation

If the asset allocation is blurred by investment styles that have been wrongly classified, we will re-align the strategies to determine the real asset allocation for your scheme. This involves re-categorising the underlying funds and placing them into new asset allocation ‘buckets’. Our analysis will reveal the actual asset allocation, which we will use to describe and measure the overall risk in the portfolio

Step 3: Report preparation

The next stage of the process involves preparing a report to outline our findings. The report illustrates the inner workings of your portfolio and provides clarity on all of the exposures. We talk you through the implications and arm you with the information you need to make decisions about any changes that may be required.

Step 4: Monitor and review

The last stage in our process involves monitoring and review. We work with you to monitor changes and analyse your portfolio in terms of risks and returns. We understand that conditions change over time, so we agree to review your scheme at regular time intervals to ensure risk is being appropriately managed.