We realise that as a family office you need to demonstrate your value and justify your investment decisions. We can dissect and analyse your portfolios to provide a useful consolidated view. Our reports and feedback ensure your portfolio is correctly structured. We can also help you develop a system for reporting on an ongoing basis, keeping your stakeholders informed and up-to-date.

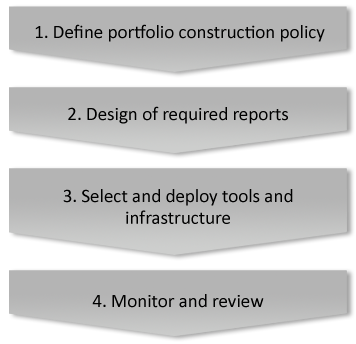

We use a structured 4 Step Approach to understand your investment process, define your portfolio construction policy and establish the most appropriate way to manage risk and develop customised reports for your stakeholders.

Step 1: Define portfolio construction policy

Using a combination of interviews and analysis, we identify the strategies you are employing in your portfolios. We take time to understand your investment approach and different portfolio objectives. We review your asset allocation strategy and look at the underlying investments to determine if they are appropriate to deliver against your stated objectives.

Step 2: Design of required reports

We use the information obtained in step one to create your Risk Policy, which we deliver to you in a book format. We select relevant indicators to describe and measure the risks within your portfolios. Working with you, we take time to understand and define the specific needs of the families you work for. We then set-up your risk limits and design the format for your risk reports, including your Risk DashboardTM

Step 3: Select and deploy tools and infrastructure

The third stage of the process involves defining the infrastructure that will allow you to measure and monitor the risks defined in your Risk Policy. We identify all of the available systems and consider any gaps. We find ways to work around or fill the gaps, then help you to launch your reporting platform.

Step 4: Monitor and review

The last stage in our process involves proactive monitoring and review. We monitor limits and analyse your portfolios in terms of risk and return. Understanding that conditions change over time, we review your risk policies and adapt or amend as required. By documenting your approach we are helping you to validate the strength of your process and promoting the value you bring to your stakeholders.